On Your Side: Stimulus checks & filing taxes

On Your Side: Stimulus checks & filing taxes

If you didn't receive all or any part of your stimulus payments, now is the time to take action.

DALLAS - If you didn't receive all or any part of your stimulus payments, now is the time to take action.

New fine print to figure out this tax season that for millions of Americans will mean finally getting their stimulus payments.

Mark Ramsay is a Dallas-based tax advisor. He says if you haven't received your stimulus payments in full and you qualify, you'll need to fill out a new form.

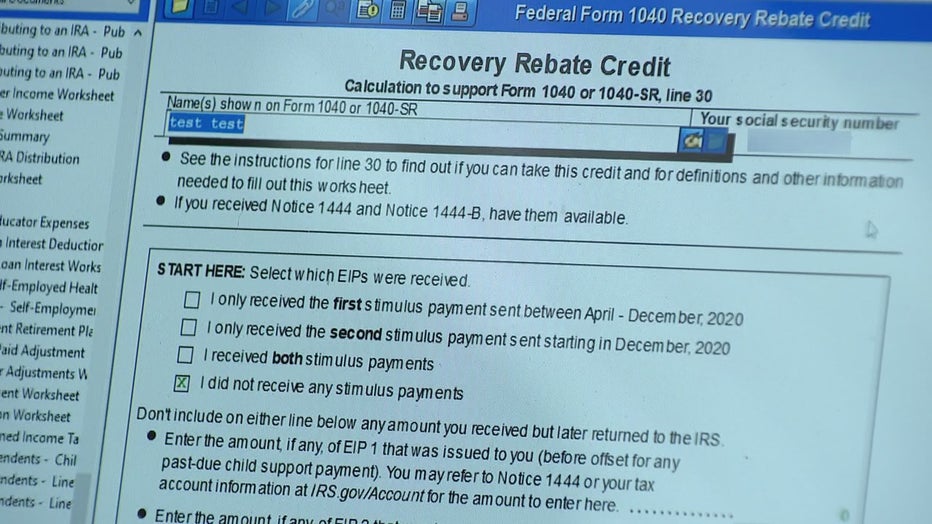

"If you have not received the stimulus, you can receive it as an increased refund on your 2020 tax return," he explained. "You need to complete the 1040-SR form, which is the Recovery Rebate Credit."

On it, you'll tell the IRS how much of that stimulus money you missed for yourself or your dependents.

"The tax software is going to calculate for you what your credit should have been, subtract what you did receive and give you the difference," Ramsay said.

It will come to you in the form of credit, increasing your refund.

For those who already got their stimulus payments in full, despite any rumors you hear, you do not have to pay that money back come tax time.

"If you did receive the stimulus check and you typically get a $2,000 refund, that will not change," Ramsay said. "You’ll still get the $2,000."

Unsure if you're owed stimulus money? You can search for your name on the IRS website.

Get a strange or error message or simply see that you don't receive your payments? Then you need to file the 1040-SR form, even if you usually don't file any tax return at all.

It will also make you easier to find when the next round of checks are issued.

You can file for free through the IRS website, which is also where you can check to see if you're owed stimulus money.

LINK: https://irs.gov/newsroom/recovery-rebate-credit