Texas Legislature's second special session begins with property tax deadlock

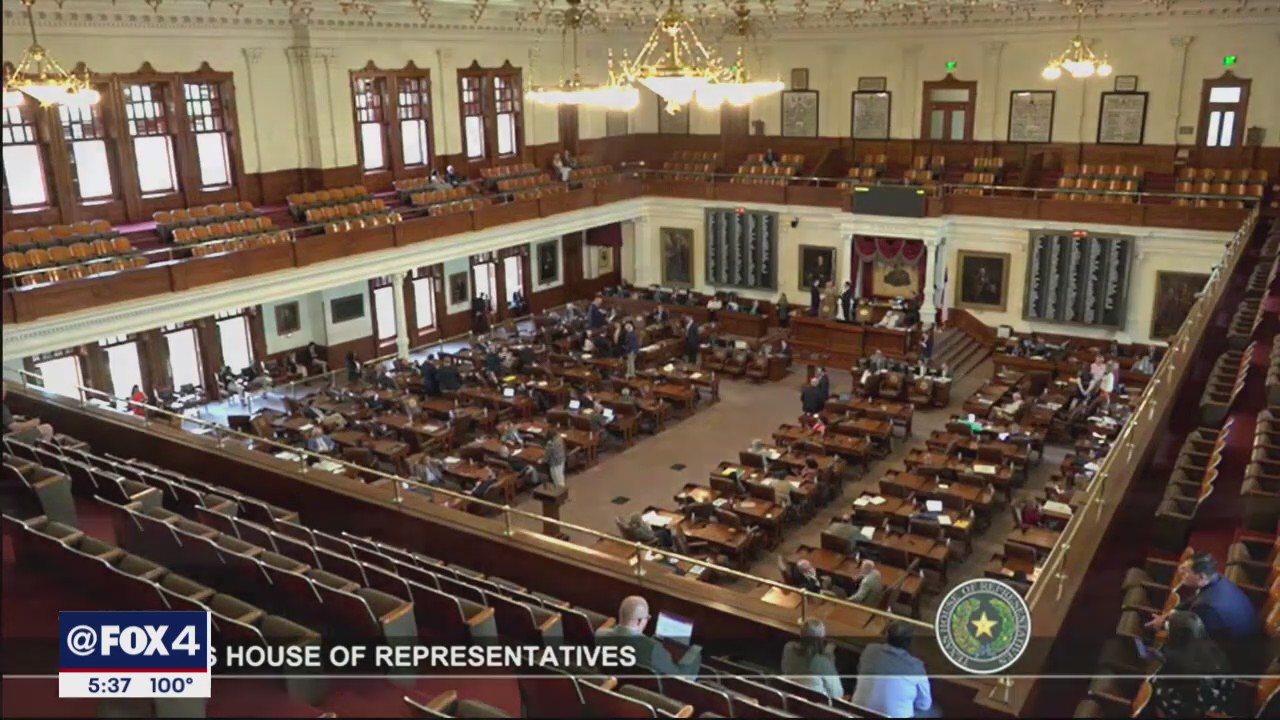

Texas Legislature's second special session begins

Texas lawmakers have already been called back for a second special session after failing to reach a deal on property tax cuts in the first one.

AUSTIN, Texas - Texas lawmakers have already been called back for a second special session after failing to reach a deal on property tax cuts in the first one.

Property tax relief has the support of millions of Texans.

But the issue has caused a sharp divide in the Texas Legislature with the House and Senate unable to agree on the best approach.

Wednesday is day two of the second special session in Austin, and they're basically starting where they left off with an impasse.

But the Senate did make things interesting by bringing in another unresolved issue from the last session.

Gov. Greg Abbott called it and devoted it solely to lowering property taxes. The governor is locked in a tense back and forth with Lt. Gov. Dan Patrick.

MORE: Texas Legislature News

The Texas Senate unanimously passed their version that includes a $100,000 homestead exemption. It’s almost the same version of what they passed in the first session.

But Senator Roland Gutierrez (D-San Antonio) proposed an amendment that got unanimous support.

"A $2,000 supplemental payment for our urban teachers and a $6,000 supplemental payment — not a raise — supplemental payment for our rural teachers," he proposed.

In total, $3 billion of surplus money was added to the Senate bill for public teacher bonuses.

Political scientists have said the Senate homestead exemption version has a longer lasting impact to taxpayers, but it didn’t have the support of Gov. Abbott and the House.

In the House, lawmakers passed their bill in committee and will return Friday. The House tax bill focuses on compressing the maintenance and operations portion of a school property tax.

Homeowners will see financial relief in the House version but only for two years.

Lt. Gov. Dan Patrick says he texted House Speaker Dade Phelan telling him the best way to negotiate is in person.

"With the homestead exemption part of this, a teacher who owns a home is not only will they get a supplemental raise, the next two years, they are also going to get a big cut on their school property tax," Patrick said.

The Senate version also eliminates the franchise tax to more than 60,000 small businesses.

Both sides come back Friday.

Abbott said he will keep calling lawmakers into special sessions until they send him a compromise bill that he supports and will sign.

At this point, it’s hard to imagine how the deadlock will be broken.