Texas representative calls for voters to decide on future of property taxes

Proposal would require voters to OK property tax hikes

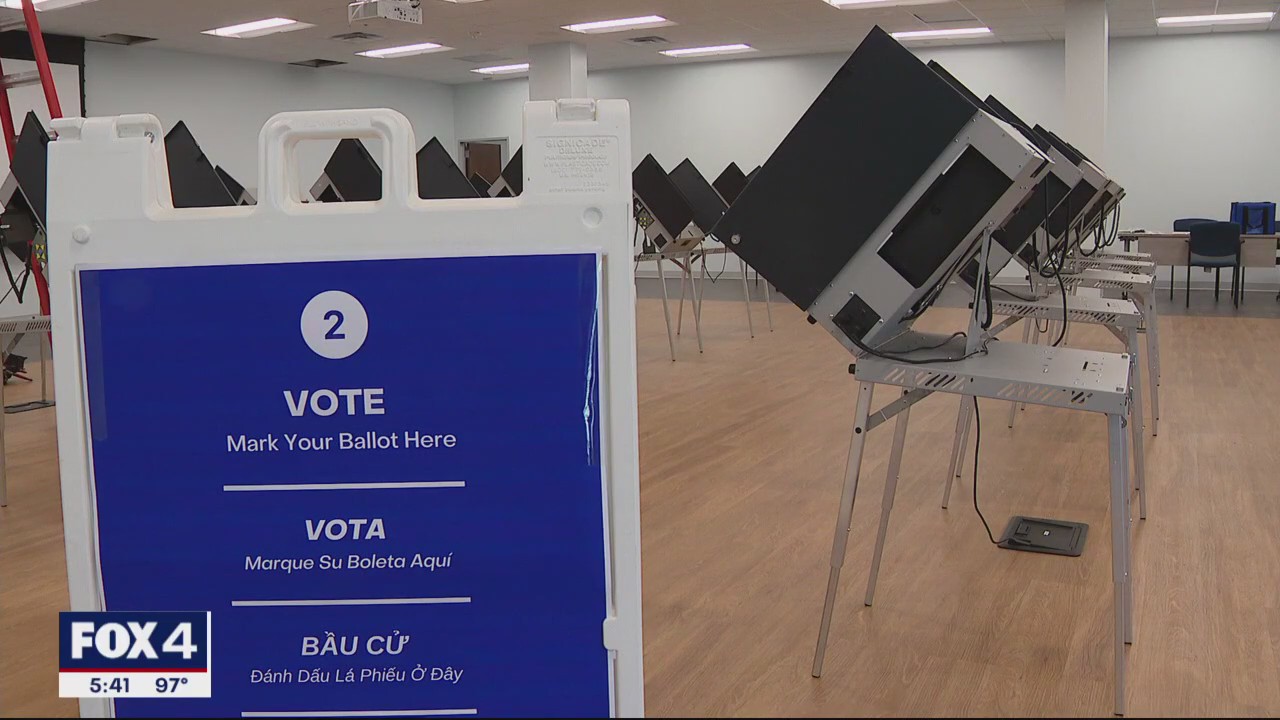

State Representative Brian Harrison, a Republican from Waxahachie who favors eliminating property tax in Texas, filed legislation that would let you, the voter, say yes or no on property tax rate increases.

AUSTIN, Texas - The standoff over property tax relief for Texans continues between Republican leadership in the Lone Star State.

Republican leaders are split over whether they should raise homestead exemptions or compress the tax rate, but those aren't the only plans on the table.

State Representative Brian Harrison, a Republican from Waxahachie who favors eliminating property tax in Texas, filed legislation that would let you, the voter, say yes or no on property tax rate increases.

"If you're a local government, and you want to raise property taxes, you should have to call an election," said Harrison. "Let the voters be in charge and let them decide whether they agree with you or whether they think their level of taxes is just too much."

Harrison says there is a way to eliminate property taxes in Texas.

State Rep. Brian Harrison (R-Waxahachie)

"You can never own your home with a system of property taxes they're unethical, they're inconsistent with private property rights, and we've got to abolish property taxes in Texas," he said.

Harrison argues it is already being done. Some Texas towns, though smaller, have created needed revenue without the tax, according to the state representative.

"They do it on a variation on a consumption tax, so a sales tax, but it's unclear whether that rate would even have to go up very much at all because we would have such a broad base we could keep the tax rate really low," argues Harrison.

MORE: Texas Legislature News

SMU economist Mike Davis is not so sure that Harrison's proposal will work.

"We could abolish the property tax and raise sales taxes to a really, like European level, maybe 15 or 20 percent. That would all work, but if you want the stuff that government does, if you want a police force, if you want schools, if you want roads, one way or another you have to pay for that," said Davis.

The debate over tax relief was made possible by this year's record surplus in tax revenue, but Davis is concerned that legislators may be too optimistic about the economic future.

"I don't mean to say we won't continue growing as a state, I think we will and I hope we will, but the job of the legislature is really to be grumpy," Davis said. "To think, well what happens during the bad times?"

Lawmakers are back in Austin for the second special session this week.

Governor Abbott has vowed to keep them at the Capitol until they agree on a property tax relief bill to his liking.

"Quite frankly, if the governor has to keep us in Austin until 2025, if that what it takes to deliver truly historic property tax relief, I hope he does it," said Harrison.

It seems the state's leadership is not budging on what they think is the best way to address property tax relief.

The second special session starts on Wednesday.